External Sources of Finance

- New business startups may be seek external finance from family and friends

- This is usually a very cheap source of funds with ‘no strings attached (e.g. a share of the business)

- This is usually a very cheap source of funds with ‘no strings attached (e.g. a share of the business)

- As the business grows, a more sources of finance are available

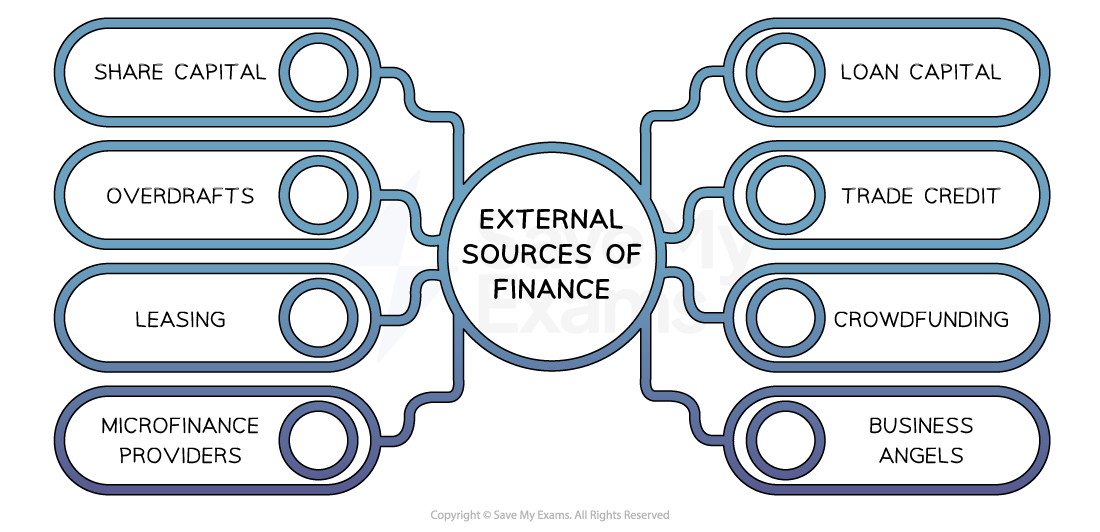

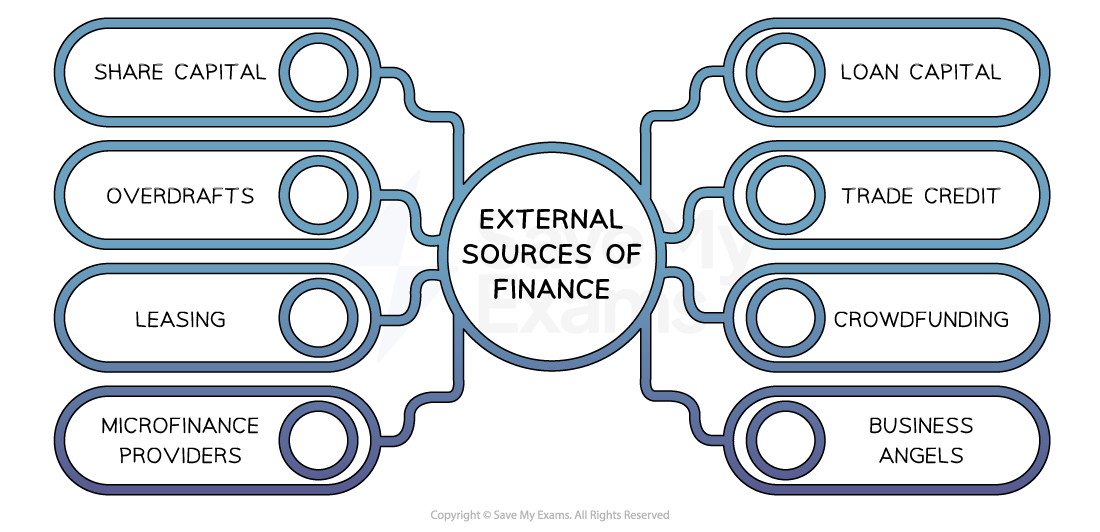

The external sources of finance available to businesses

- Businesses often make use of a range of sources of finance that meet different needs

- For example, long-term loans or share capital are likely to be most suitable sources of finance to fund capital expenditure including the purchase of land, buildings or machinery whilst overdrafts may be used to solve short-term cash flow problems

- For example, long-term loans or share capital are likely to be most suitable sources of finance to fund capital expenditure including the purchase of land, buildings or machinery whilst overdrafts may be used to solve short-term cash flow problems

An Explanation of the main External Sources of Finance

Method of Finance |

Explanation |

|

Share Capital |

|

|

Loans |

|

|

Overdrafts |

|

|

Trade Credit |

|

|

Leasing |

|

|

|

|

|

Micro-finance Providers |

|

|

Business Angels |

|

Exam Tip

Recently, small and medium-sized businesses have found some sources of finance trickier to access. When evaluating external sources of finance in your answers, acknowledge that businesses may find accessing these sources more challenging and expensive than in previous years.

Peer to Peer lending, Crowdfunding and sources such as Business Angels have been able to fill some of the gaps left by changes in the banking industry.

Recognising that a business may not be able to achieve its objectives due to an inability to borrow can be a useful evaluative point.